Top Videos

Taylor Swift fans descend on London pub name-checked on album

FRANCE 24 English

Congress Sends Biden a Bill That Could Ban TikTok

Wibbitz Top Stories

Jon Stewart Blasts Media Coverage of Trump Trial | THR News Video

The Hollywood Reporter

Germany's Steinmeier calls for revival of ties with Turkey

Deutsche Welle

Germany: AfD's Krah faces probe on Russia, China 'payments'

Deutsche Welle

Germany: AfD's Krah faces probe on 'Russia, China payments'

Deutsche Welle

Ukraine: US to deliver weapons via Germany and Poland

Deutsche Welle

Advertisement

In shock, Spain’s ‘Mr Handsome’ PM may resign over probe of wife’s business

Sydney Morning Herald

Spain: PM Sanchez suspends public duties as wife probed

Deutsche Welle

EU Marks 20th Anniversary of Deadly Madrid Train Bombings

Wibbitz Top Stories

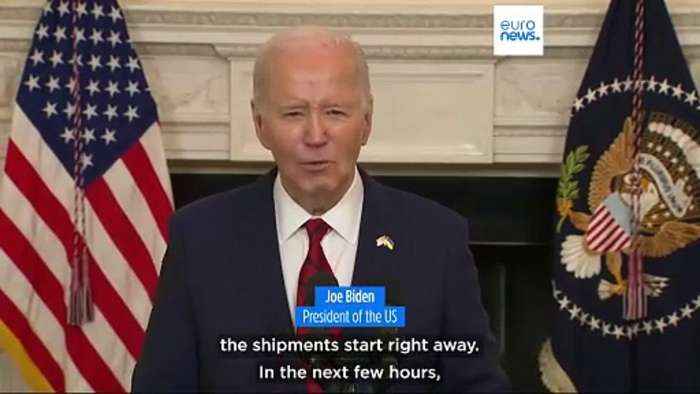

Ukraine updates: Biden signs bill releasing US military aid

Deutsche Welle

How The US Coalition In The Red Sea Is Not Helping – OpEd

Eurasia Review